Ideal Info About How To Control Credit Card Debt

Tips and strategies to get control of credit card debt.

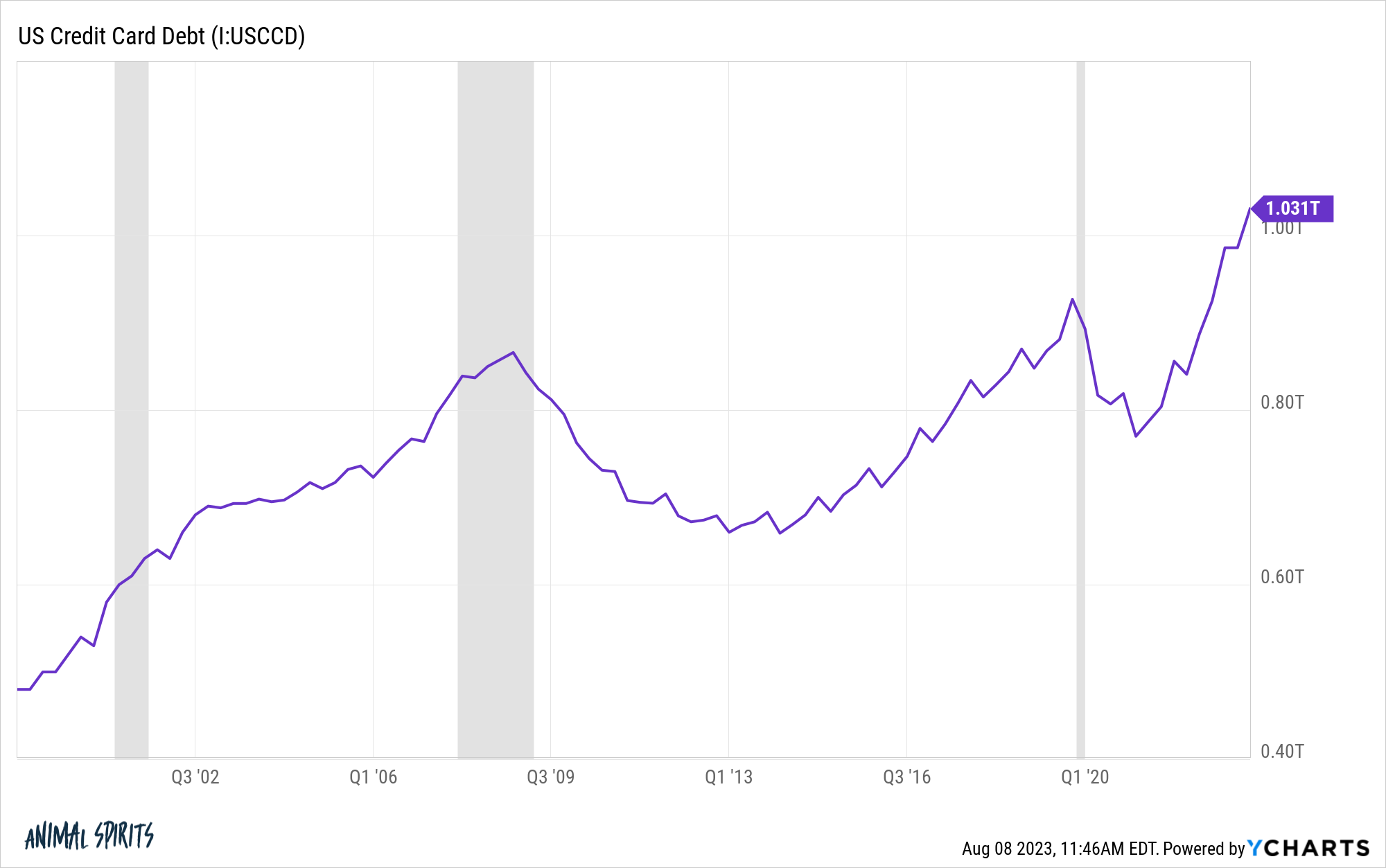

How to control credit card debt. How to pay off credit card debt. By the fourth quarter of 2022, however, general purpose credit card debt rebounded to $ 935 billion, above the $867 billion mark reached in the fourth quarter of. Having a concrete repayment goal and strategy will help keep you — and your.

Pay off debt fast and save more money with financial peace university. Problem debt vs managed debt. Check what grants and benefits you can get.

8 tips to manage and reduce credit card debt. If you want to get. Is your debt a problem?

If you carry a balance, try to pay off more than the minimum payment each month. If you feel your credit card debt is out of control, speak to your card providers and see what help they can offer. But depending on your situation, pros and cons may exist.

Next, move to the account with the next highest interest rate and repeat the process until you pay off all of your credit card balances. One of the most common ways to consolidate your credit card debts is to reach out to your local bank or credit union and request a personal loan. Pay off your balance in full each month to avoid interest charges.

Paying your bills on time and lowering your debt burden are the two big ones, and there are other tricks of the trade that are worth researching as well. Make savings where you can. It involves taking out a new loan or opening a new line of credit and using it to pay off your existing debts.

Note that settling credit card debt is different from — and riskier than — simply negotiating the cost of existing debt, such as attempting to get fees waived or aprs lowered. Consider using a credit card with a lower interest rate. Find a payment strategy or two.

Eliminating all of your debt. 20, 2024 updated 3:03 pm pt. Announced monday that it had reached an agreement to acquire discover financial services for $35.3 billion, instantly creating a.

Managing your credit card debt is key to maintaining healthy finances and a strong credit score. Not every debt payoff strategy or tip will be suitable for your situation and some may be unavailable to you. Here are several techniques for paying off credit card debt the smart way.

Mortgage brokers & financial advisers. Pay debts off in order of interest rate. When that happens, it can be beneficial to consider credit card debt forgiveness.