Matchless Tips About How To Claim Capital Loss In Canada

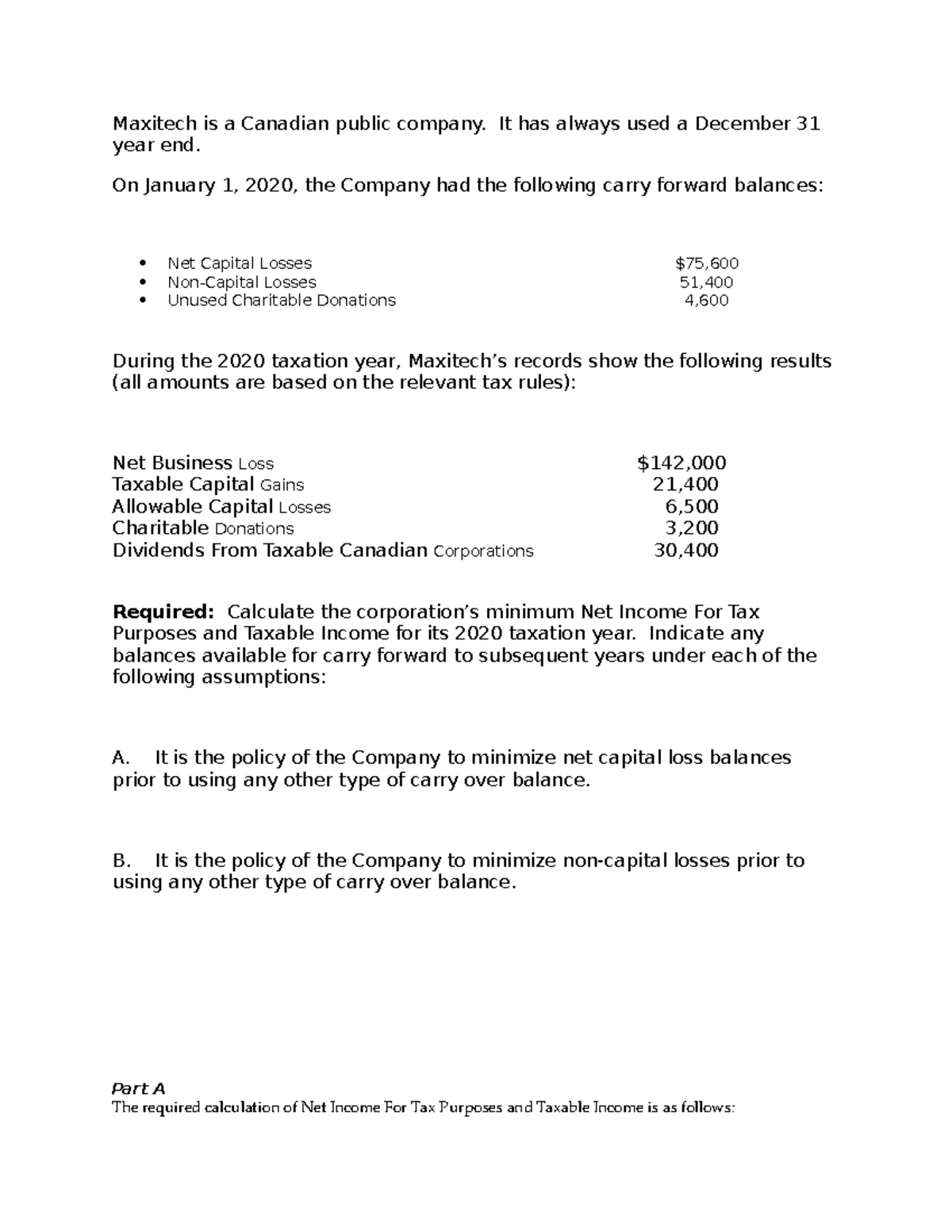

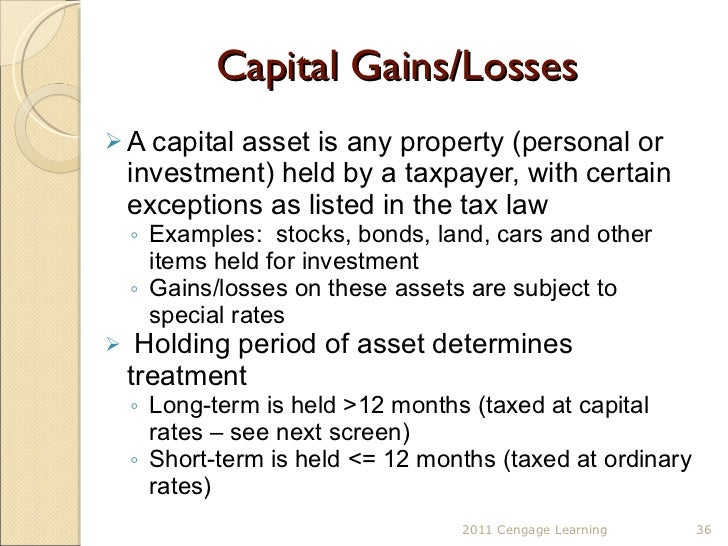

You cannot use capital losses to offset other types of income like business income.

How to claim capital loss in canada. If your only capital gains or losses are those shown on information slips (t3, t4ps, t5, or. The topics below provide information on capital losses, and on different treatments of capital gains that may reduce your taxable income. If you have more losses than gains in a year, you can “carry” the remaining losses.

Consult our summary of loss. Once the superficial loss is triggered, you are not allowed to claim the capital loss. When taxpayer incurs a loss, they can use the loss to offset income.

Cottages antiques overall, capital gains are a good thing; You can only use capital losses to reduce capital gains. The cra will register it on their system.

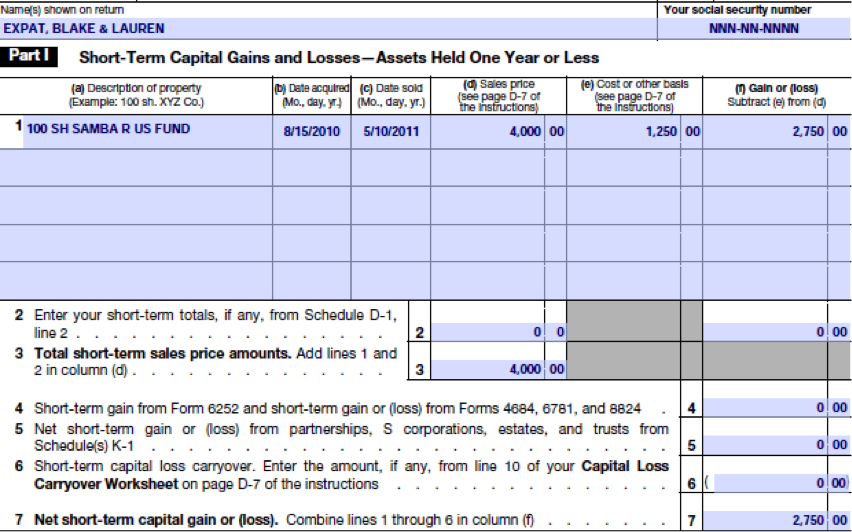

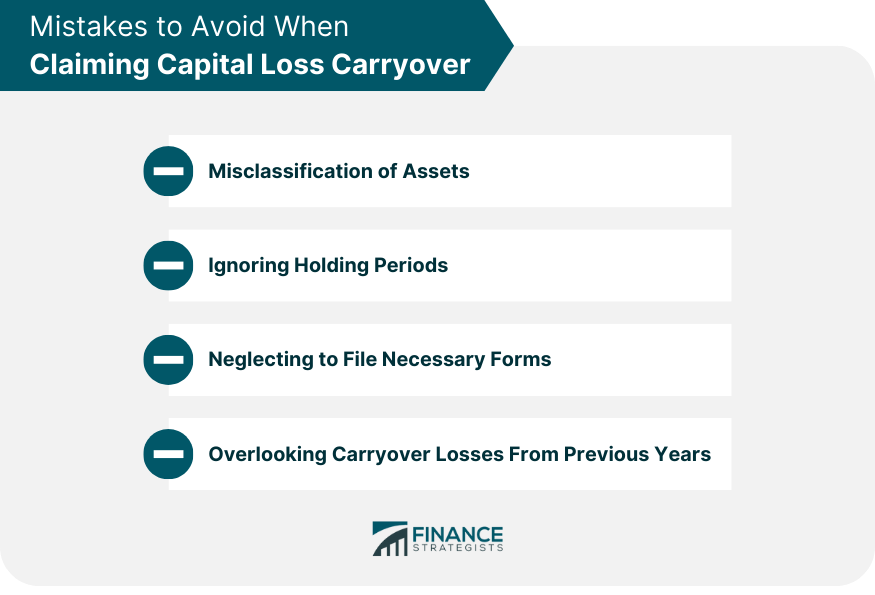

How to carry back a capital loss for a tax refund let’s look at the rules and restrictions around carrying back a capital loss, as well as three things to consider. Allowable capital losses = 50% x capital losses. A loss carryback can be applied to any of the past 3 years’ returns.

If you had a capital gain in 2021 of $8,000 and a capital loss of $5,000 in. To calculate your rental losses, you must fill out form t776 — statement of real estate rentals. First, a bil is a capital loss that arises from the disposition of a share of a.

This form includes sections for you to enter the amount of rent. The amount of the capital loss is not lost forever, but rather added to the adjusted cost base. When you sell a qualified small business corporation shares or.

Net capital losses = the excess of. If you later dispose of the xyz shares on the open market for $90, you will. Claim a capital gains deduction, or declare a capital gains reserve.

A capital loss can be deducted against capital gains realized in the same year. Claiming a capital gain deduction: Claim the $25 capital loss at the time of the transfer;

This year’s general tax filing deadline is april 30, 2024. Loss carryovers are an important tool that taxpayers can utilize to reduce their taxable income. Taxable capital gains = 50% x capital gains.

The act, however, restricts the scope of investment losses that qualify as bils. The canada revenue agency (cra) has recently discovered a tax scheme that targets newcomers to canada. If the amount on line 19900 of your schedule 3 is negative (a loss), do not claim the amount on line 12700 of your return.